Historical Background Of Banking

Historical Background Of Banking

History of Banking in India

Banking in India in the modern sense originated in last decades of the 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829 - 32.

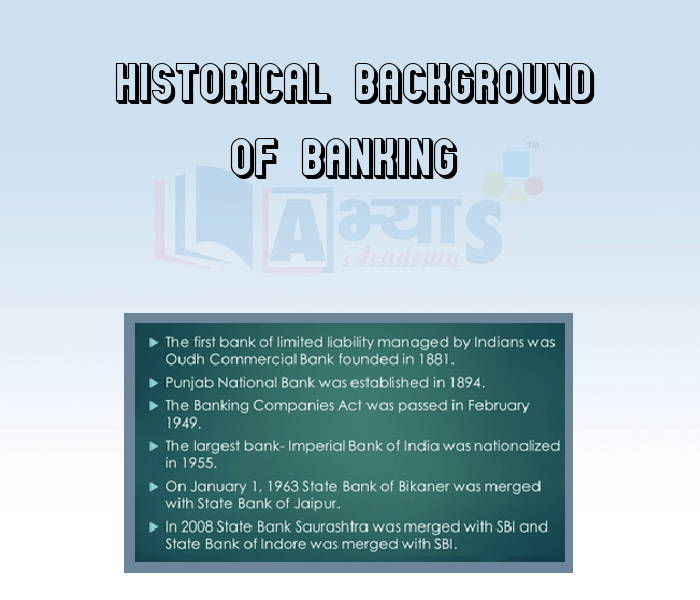

The first bank of limited liability managed by Indians was Oudh Commercial Bank or Awadh Commercial Bank founded in 1881. Punjab National Bank was established in 1894.

Swadeshi movement, which began in 1906, encouraged the formation of a number of commercial banks. Banking crisis during 1913 -1917 and failure of 588 banks in various States during the decade ended 1949 underlined the need for regulating and controlling commercial banks.

The Banking Companies Act :

It was passed in February 1949, which was subsequently amended to be read as Banking Regulation Act, 1949.This Act provided the legal framework for regulation of the banking system by RBI. The largest bank - Imperial Bank of India - was nationalised in 1955 and rechristened as State Bank of India, followed by formation of its 8 Associate Banks in l959.

The largest and oldest bank still in existence is the State Bank of India. It originated as the Bank of Calcutta in June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks funded by a presidency government; the other two were the Bank of Bombay and the Bank of Madras. The three banks were merged in 1921 from the Imperial Bank of India, became the State Bank of India in 1955. For many years the presidency bank had acted as quasi - central banks, as did their successors, untill the Reserve Bank of India (RBI) was established in 1935, under the Reserve Bank of India Act, 1934.

In 1960, the State Bank of India was given control of eight state - associated banks under the State Bank of India (Subsidiary Banks) Act, 1959.

Nationalisation in the 1969: (19 July 1969)

With a view to bring commercial banks into the mainstream of economic development with definite social obligations and objectives, the Government issued an ordinance on 19 July 1969 acquiring ownership and control of 14 major banks in the country. In 1969, the Indian government nationalised 14 major private banks (Commercial banks). In 1980, 6 more private banks (Commercial Banks) were nationalised. [Andhra Bank, Corporation Bank, Oriental Bank of Commerce (OBC), Punjab & Sind Bank, Vijaya Bank, New Bank of by India]. Later on, in the year 1993, the government merged New Bank of India with Punjab National Bank. It was the only merger between nationalised banks and resulted in the reduction of the number of nationalised banks from 20 to 19.

Liberalization in the 1990's

In the early 1990's, the government embarked on a policy of liberalization, licensing a small number of private banks. These came to known as New Generation Techsavvy banks and included Global Trust bank, which later amalgamated with oriental Bank of Commerce, UTI Bank (since renamed Axis Bank), ICICI bank & HDFC bank.

The new policy shook the banking sector in India completely. Bankers, till this time, were used to the 4 - 6 - 4 method (borrow at 4%, lend at 6%, go a home at 4%) of functioning.

SBI Merger

Five associate banks, State Banks, of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad, State Bank of Mysore (SBM), State Bank of Patiala (SBOP) and State Bank of Travancor (SBT) merged in SBI under SBI Act 1955. Other two banks State Bank of Saurashtra and State Bank of Indore got merged in 2008 and 2010. Thus, SBI controls 25% portion of Indian Banking Industry and in terms of Assets size SBI 45th biggest bank in the world. Apart from this Bhartiya Mahila Bank (BMB), also merged with SBI, which was set up in 2013.

This largest consolidation exercise in banking history of India be effective from 1 April 2017.

Under provisions of which one of the following Acts, does the RBI issue directives to the banks in India? | |||

| Right Option : D | |||

| View Explanation | |||

Students / Parents Reviews [20]

A marvelous experience with Abhyas. I am glad to share that my ward has achieved more than enough at the Ambala ABHYAS centre. Years have passed on and more and more he has gained. May the centre flourish and develop day by day by the grace of God.

Archit Segal

7thOne of the best institutes to develope a child interest in studies.Provides SST and English knowledge also unlike other institutes. Teachers are co operative and friendly online tests andPPT develope practical knowledge also.

Aman Kumar Shrivastava

10thMy experience with Abhyas academy is very good. I did not think that my every subject coming here will be so strong. The main thing is that the online tests had made me learn here more things.

Hiya Gupta

8thMy experience with Abhyas academy is very nice or it can be said wonderful. I have been studying here from seven class. I have been completing my journey of three years. I am tinking that I should join Abhyas Academy in tenth class as I am seeing much improvement in Maths and English

Hridey Preet

9thWhen I have not joined Abhyas Academy, my skills of solving maths problems were not clear. But, after joining it, my skills have been developed and my concepts of science and SST are very well. I also came to know about other subjects such as vedic maths and reasoning.

Sharandeep Singh

7thMy experience with Abhyas is very good. I have learnt many things here like vedic maths and reasoning also. Teachers here first take our doubts and then there are assignments to verify our weak points.

Shivam Rana

7thAbhyas institute is one of the best coaching institute in the vicinity of Ambala cantt.The institute provides good and quality education to the students.The teachers are well experienced and are very helpful in solving the problems. The major advantages of the institute is extra classes for weak...

Shreya Shrivastava

8thAbhyas is an institute of high repute. Yogansh has taken admission last year. It creates abilities in child to prepare for competitive exams. Students are motivated by living prizes on basis of performance in Abhyas exams. He is satisfied with institute.

Yogansh Nyasi

7thAbhyas Methodology is very good. It is based on according to student and each child manages accordingly to its properly. Methodology has improved the abilities of students to shine them in future.

Manish Kumar

10thAbout Abhyas metholodology the teachers are very nice and hardworking toward students.The Centre Head Mrs Anu Sethi is also a brilliant teacher.Abhyas has taught me how to overcome problems and has always taken my doubts and suppoeted me.

Shreya Shrivastava

8thWe started with lot of hope that Abhyas will help in better understnding of complex topics of highers classes. we are not disappointed with the progress our child has made after attending Abhyas. Though need to mention that we expected a lot more. On a scale of 1-10, we would give may be 7.

Manya

8thAbhyas is a complete education Institute. Here extreme care is taken by teacher with the help of regular exam. Extra classes also conducted by the institute, if the student is weak.

Om Umang

10thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.

Prisha Gupta

8thMy experience with Abhyas Academy has been very good. When I was not in Abhyas whenever teacher ask questions I could not speak it confidently but when I came in Abhyas, my speaking skills developed and now I am the first one to give the answer of teachers question.

Upmanyu Sharma

7thThird consective year,my ward is in Abhyas with nice experience of admin and transport support.Educational standard of the institute recumbent at satisfactory level. One thing would live to bring in notice that last year study books was distributed after half of the session was over,though study ...

Ayan Ghosh

8thUsually we see institutes offering objective based learning which usually causes a lag behind in subjective examinations which is the pattern followed by schools. I think it is really a work of planning to make us students grab the advantages of modes of examination, Objective Subjective and Onli...

Anika Saxena

8thThe experience was nice. I studied here for three years and saw a tremendous change in myself. I started liking subjects like English and SST which earlier I ran from. Extra knowledge gave me confidence to overcome competitive exams. One of the best institutes for secondary education.

Aman Kumar Shrivastava

10thAbhyas is good institution and a innovative institute also. It is a good platform of beginners.Due to Abhyas,he has got knoweledge about reasoning and confidence.My son has improved his vocabulary because of Abhyas.Teacher have very friendly atmosphere also.

Manish Kumar

10thIn terms of methodology I want to say that institute provides expert guidence and results oriented monitering supplements by requsite study material along with regular tests which help the students to improve their education skills.The techniques of providing education helps the students to asses...

Aman Kumar Shrivastava

10thIt was good as the experience because as we had come here we had been improved in a such envirnment created here.Extra is taught which is beneficial for future.